TIPP is a monthly Tax Instalment Payment Plan offered by The Town of Morinville that provides a hassle-free method for paying property taxes through automatic bank withdrawals monthly, thus avoiding any late-payment penalties.

These monthly payments are processed through automatic bank withdrawal, spanning from January to December.

Tax Instalment Payment Plan

Our Tax Instalment Payment Plan (TIPP) allows you to spread out your tax payments equally over the calendar year (January to December) rather than making a single annual payment.

Once we've received your completed application, we will contact you with your payment details. A fixed monthly amount will be automatically debited from your bank account on the date(s) chosen: the 16thof the month, the last day of the month, or both. If your payment date lands on a holiday or weekend, the payment will be withdrawn the following business day.

Opting for this payment plan ensures that your property taxes are consistently paid in-full each year, eliminating the risk of incurring any late-payment penalties.

How it works

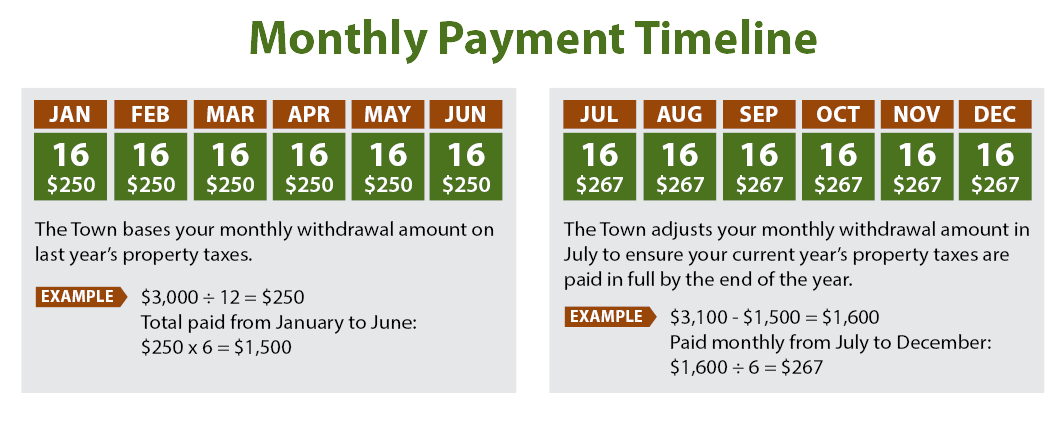

During the initial six months of the year, your monthly payment is calculated as 1/12 of the previous year's tax amount (assuming one payment per month).

Your payment is adjusted in July to reflect the new annual tax amount.

If you decide to enrol in the program at any point within the current tax year (from January 1 to December 31), you must make-up any unpaid instalments. For instance, if you initiate automatic bank withdrawals in April, you must cover the payments for January, February, and March. These previously unpaid instalments can be incorporated into your first automatic bank withdrawal.

The property tax amount for each property owner in Morinville is unique to their specific property. Joining this plan can take up to 2 weeks to process, provided that all the required supporting documentation is submitted along with your application. Please apply no later than the 1st day of the month in which you wish to begin payments.

How to apply

To enrol in the TIPP, please complete the TIPP Pre-Authorized Debit Application form by filling in all required fields and uploading a blank cheque marked VOID, or a bank deposit form.

If you are a new property owner in Morinville and not yet on the land title, we may request further documentation to verify your ownership status.

Alternatively, you can mail your application, or fill it out in person, here:

St. Germain Place (Town Hall)

10125 – 100 Avenue

Morinville AB T8R 1L6

We will contact you once we receive your application.

Valuable information

- We require a written cancellation by the 1st of the month in which you wish to cancel. If a cancellation notice is not received a minimum of 14-days prior to your desired cancellation date, your payments will continue to be withdrawn.

- Please confirm that your mortgage lender is not paying your property tax payments.

- In the event of a payment being declined by your financial institution, you will be removed from the TIPP and charged a $35.00 NSF fee. You will need to make up the missed payment in addition the the NSF fee before re-enroling in the TIPP.

- Additional payments can be made in-person or using online banking (your roll number is the account number).

- If you require any assistance, please contact our office in-person or by phone or email:

- Financial Services — 10125 100 Ave, Morinville, AB T8R 1L6

- Phone: 780-939-4361

- Email: Utility and Tax Payment

Cancellation process

If you wish to cancel your enrolment in the TIPP, ensure you provide us with a written cancellation by the 1st of the month. If a cancellation notice is not received a minimum of 14-days prior to your desired cancellation date, your payments will continue to be withdrawn.

If a payment is not honoured by your bank, your enrolment in the monthly payment plan will be cancelled. All unpaid taxes will be due and payable, and will be subject to service charges and late-payment penalties.

FAQ

How long does it take to enrol?

The application process can take up to two weeks once you submit a signed application form and banking information. If you are a new property owner in Morinville and not yet on title, the town may request further documentation to verify your ownership status.

Do I need to enrol every year?

No. Once enroled, you do not need to re-apply unless you move to a new property in Morinville.

You can enrol anytime, however, it's best to apply before November for the upcoming tax year.

These are instalments that you would have paid already if you had joined the TIPP prior to January 1.

As an example, if you apply to start monthly bank withdrawals on April 1, you will need to pay the instalments that were unpaid in January, February and March. These unpaid instalments may be included in your first automatic bank withdrawal.

If a payment is not honoured by your bank, your enrolment in the monthly payment plan will be cancelled and a $35.00 NSF fee will be applied. All unpaid taxes will be due and payable, and will be subject to service charges and late-payment penalties.

I have unpaid taxes and penalties. Can I still enrol?

Yes, but you will need to pay any unpaid taxes from prior years and any associated penalties prior to enrolling.

How are the monthly instalments calculated?

During the initial six months of the year, your monthly payment is calculated as 1/12 or 1/24 of the previous year's tax amount depending on your payment frequency.

Your payment is adjusted in July to reflect the new annual tax amount. Your property tax notice, mailed in May, will show the adjusted monthly withdrawal amount effective July 1.

Will my monthly instalments change during the year?

Your payments will be adjusted in July to reflect the new tax amount.

Your monthly withdrawal amount may be adjusted if an amended or supplementary tax is applied to your account prior to November, or if other charges or credit adjustments are processed during the year. The town will notify you of any increases in writing at least two weeks before the next withdrawal date.

Can I pay more than the scheduled monthly amount?

Yes. If you wish to increase your monthly payment amount, please submit a written request 14-days prior to your next withdrawal date:

- Financial Services — 10125 100 Ave, Morinville, AB T8R 1L6

- Email: Utility and Tax Payment

If you wish to change your banking information, please submit the new information 14-days prior to your next withdrawal date:

- Financial Services — 10125 100 Ave, Morinville, AB T8R 1L6

- Email: Utility and Tax Payment

Where do I send my completed application?

- Financial Services — 10125 100 Ave, Morinville, AB T8R 1L6

- Email: Utility and Tax Payment

How can I cancel my participation in the plan?

If you wish to cancel your enrolment in the Property Tax Monthly Payment Plan, ensure you provide us with a written cancellation notice 14-days prior to your desired cancellation date:

- Financial Services — 10125 100 Ave, Morinville, AB T8R 1L6

- Email: Utility and Tax Payment

The registered owner, or their legal representative, must submit a written cancellation notice 14-days prior to your desired cancellation date:

- Financial Services — 10125 100 Ave, Morinville, AB T8R 1L6

- Email: Utility and Tax Payment

Have any questions?

Contact us if you have any questions about the program.

Contact Us

Town of Morinville

10125 100 Ave.

Morinville, AB T8R 1L6

Phone: 780-939-4361

Subscribe

Stay up to date on the Town's activities, events, programs and operations by subscribing to our news.